ACG Insights: Small Cap Comeback?

(Download the full report HERE)

Executive Summary

- A few Large Capitalization stocks have dominated portfolio performance for years, leaving other areas of the market at attractive valuation levels

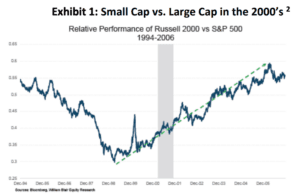

- Small Caps, despite recent underperformance relative to Large Caps, have a history of prolonged periods of outperformance (Exhibit 1)

- Both absolute and relative valuations in Small Cap are historically attractive (Exhibits 2 & 3)

- The negative impact of higher interest rates and possible recession may already be baked into Small Cap prices, which tend to outperform coming out of recessions (Exhibit 4)

Background

The state of markets to this point in 2023 has put asset allocators in an interesting spot as we think about portfolio positioning. On one hand, US Large Cap, and more specifically US Large Cap Growth, has driven performance in most portfolios for several years. The former “FANG” cohort has evolved into the “Magnificent Seven” (Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, Nvidia) to neatly package the big tech companies that have come to dominate major market indexes. Through October of this year these seven companies make up about 30% of the S&P 500 and have returned over 70% in 2023 while the remaining 493 companies in the index have risen only about 6%1 . On the other hand, the narrow recent performance profile has left other areas of equity markets in attractive positions based on relative valuations. Take away US Large Cap Growth and you could almost throw a dart to find an area of the market that looks ripe for some mean reversion. One area looking increasingly attractive is US Small Cap, where investors may have already priced in worries over higher interest rates, recession, and tepid economic growth. The flashing disclaimer would be that valuations can stay elevated or depressed for indefinite periods, making perfect timing virtually impossible.

Why Bother with Small Caps?

The easiest answer is that they tend to outperform over time, and they do have precedent of significant outperformance over Large Caps. Exhibit 1 (right) shows the relative performance of Small Cap companies relative to Large Cap from the late-1990’s through mid2000’s, a period encompassing a significant tech bubble and a recession. In terms of annualized returns, the S&P 600 (Small Cap) returned about 11.5% per year from 1999-2006 compared to 3.5% for the S&P 500 (Large Cap)3 .

Recent performance tends to have the gravitational pull of a black hole in the investment world, and it has been hard to ignore the outperformance of mega-cap technology companies in recent years. The “Magnificent Seven” will likely maintain their influence on market indexes for the foreseeable future due to their market positions and breadth. At some point the question will shift from the market dominance and growth prospects of the market leaders to how much investors are willing to pay for more projected growth.

Download the full report HERE where we discuss

- Current Valuations

- What about Interest Rates and Recession?

Sources:

- Goldman Sachs

- William Blair: Where are we in the Small-Cap Cycle?, October 20, 2023

- Morningstar Direct

- Franklin Templeton

- William Blair

- wsj.com: These Stocks Are Trailing the Market by the Widest Margin in 25 Years

- Glenmede

- Morningstar: https://www.morningstar.com/markets/markets-brief-is-it-finally-time-buy-small-cap-stocks