ACG Insights: Treasury Market Dilemma with Deficits

(Download the full report HERE)

Executive Summary

- In tandem with annual fiscal deficits, there has been a rise in Treasury issuance

- Despite the vast size and stability of the Treasury market, there are concerns regarding how the Treasury market will respond to prolonged debt growth and a transitioning investor base

- Weak Treasury auctions, potential downgrades in U.S. debt ratings, and the return of term premium are all things to watch as the situation is unlikely to change in the near future

Background

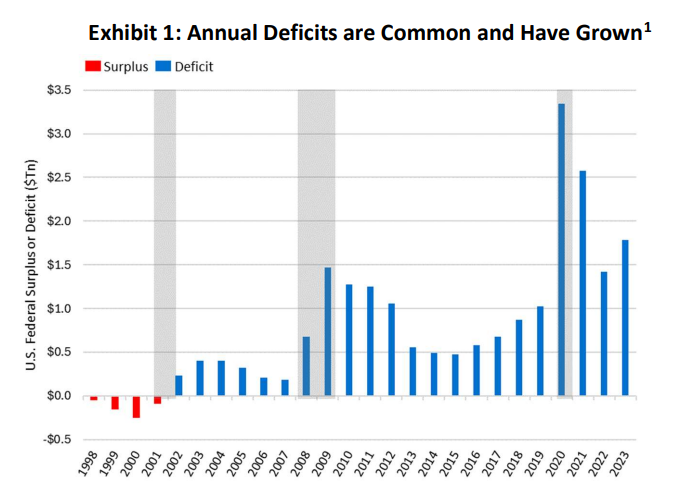

Apart from a few years in the late 90’s and early 2000’s, the U.S. government has consistently operated at a deficit, where spending exceeds revenues from taxes. Federal or fiscal deficits are not categorically negative and are quite common globally. Nevertheless, the Treasury Department needs to borrow money by issuing Treasurys to bridge the gap between spending and revenues.

Historically, national debt tends to decline during times of prosperity, but the postpandemic era has proven to be an exception with issuance rising to meet growing entitlement spending (Social Security, Medicare, etc.), pandemic related stimulus, and rising interest payments (Exhibit 2). Some investors are worried about the sustainability of federal debt outpacing economic growth, and the impact on interest rates and the treasury market.

How Treasurys are Sold

The method of issuing Treasurys to investors is worth noting, as the competitive auction process sets the yield for new issues. The Treasury Department announces their borrowing plans in advance of conducting maturity specific bond auctions, offering any and all participants the opportunity to invest in reliable coupon payments with the security of a government guarantee. “Primary dealers” are one of the key participants. These select banks are required to bid at Treasury auctions and often buy more bonds when demand is weak. “When-issued” or advanced trading among primary dealers helps set expectations for the new bond’s yield.

Download the full report HERE where we discuss:

- Investor Base for U.S. Treasurys

- What to Watch: Treasury Auctions, U.S. Credit Ratings, and the Return of Term Premium

Sources

- Federal Reserve Economic Data

- SIFMA, WSJ https://www.wsj.com/finance/the-27-trillion-treasury-market-is-only-getting-bigger-a9a9d170

- FFUNDS, Haver, Apollo. “Real money” includes U.S. pensions, U.S. insurance companies, and U.S. asset managers

- Dollar amount of bids received divided by the amount sold

- Moody’s, Fitch, and Standard & Poor’s as of 12/31/2023

- Federal Reserve Bank of New York as of 3/22/2024