Tighter Fed Expectations Not Slowing Markets

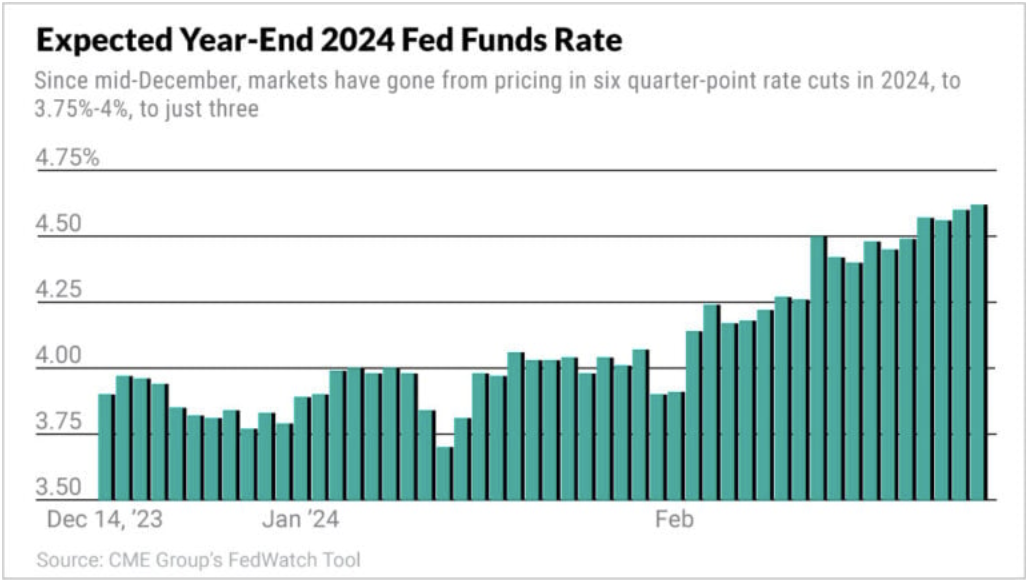

- Market participants are beginning to recognize that interest rates may stay higher for longer (see chart), with expectations over the last few weeks moving from several cuts to 2-3 cuts by the end of 2024.

- Interestingly, expectations for more restrictive financial conditions have not done much to slow down risk assets.

- The S&P 500 is up more than 7% in 2024 through the end of February while Bitcoin, which if nothing else has been a decent proxy for risk appetite in markets, is up more than 40%.

- This is a small sample size, but it’s worth contrasting against the narrative that Fed policy has a significant impact on markets in the short/intermediate term.

Sources:

- Investor’s Business Daily; https://www.investors.com/news/economy/fed-rate-cuts-federal-reserve-sp-500/

- Morningstar Direct

Connect With Us

Interested in learning more? The professional advisors at ACG are happy to answer any questions you

have. Contact us to discuss solutions and discover how our advisors bring value to your institution.