Should You Time The Market?

- The S&P 500 Index recently breached 5,000 for the first time and has hit new all-time highs multiple times in recent trading days.

- Intuition would likely say that new all-time highs for stocks would portend lower returns going forward due to elevated valuations, a peak in earnings growth, or maybe frothy investor sentiment.

- It’s common for investors to be nervous about putting new money to work with markets at or near all-time highs.

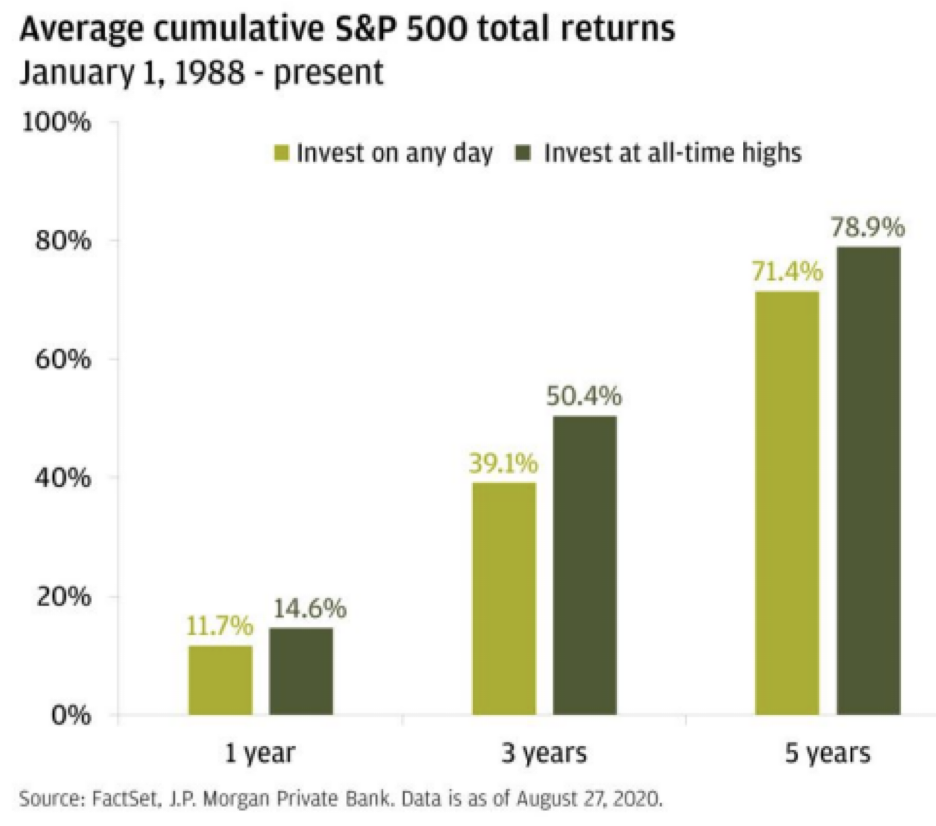

- Data shows that this worry may be misplaced, as investing in the S&P 500 at all-time highs led to higher returns over time than if money was invested on days when the index was not at a peak (see chart).

- The usual caveat that past performance does not guarantee future results is especially true here. The dominance of US mega-cap tech companies that have driven indexes should slow at some point, but has been costly to bet against for longer than many expected.

Sources: JPMorgan; https://www.jpmorgan.com/content/dam/jpm/securities/documents/cwm-documents/Is-it-worth-considering-investing-at-all-time-highs.pdf

A Wealth of Common Sense; https://awealthofcommonsense.com/2024/02/all-time-highs-usually-lead-to-more-all-time-highs-in-the-stock-market/

Connect With Us

Interested in learning more? The professional advisors at ACG are happy to answer any questions you

have. Contact us to discuss solutions and discover how our advisors bring value to your institution.