ACG’S July Capital Markets Review

(Download the full report HERE)

Market Highlights

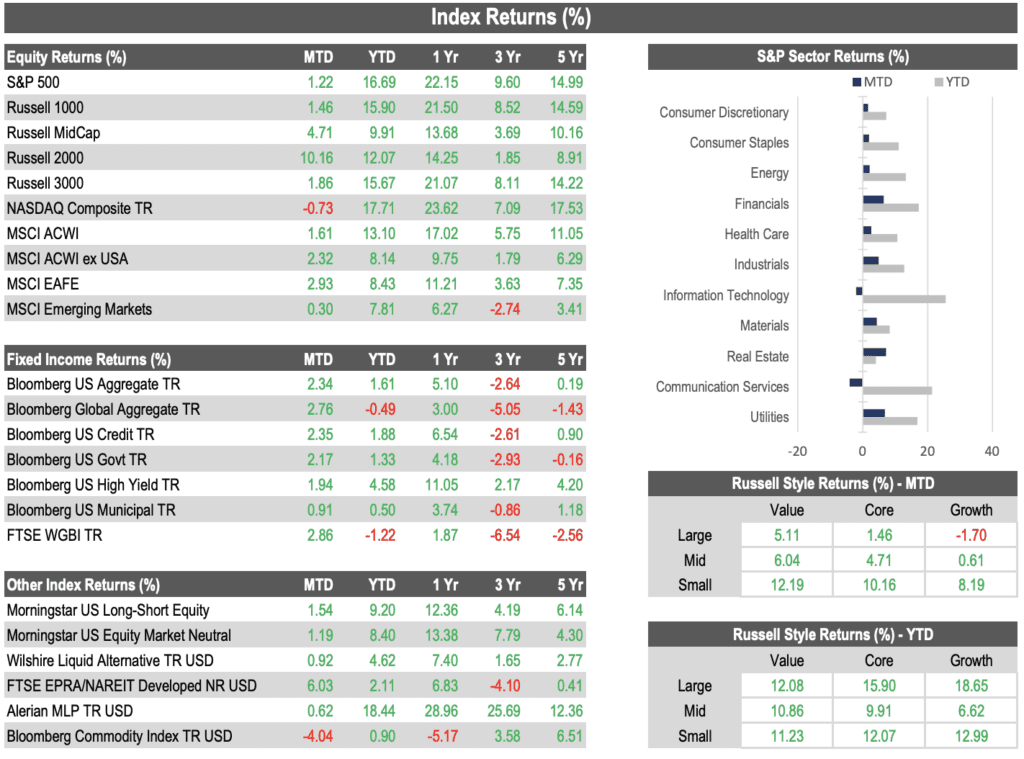

- July saw a rotation of sorts from Large Cap and Growth equities towards Small Cap and Value oriented names, as a cool inflation report for June raised hopes for lower rates in the near future.

- The S&P 500 was up +1.22% for the month and is now +16.69% higher on the year.

- Small Cap stocks staged a significant rally with the Russell 2000 rising +10.16% over the course of the month.

- The Real Estate sector, long out of favor, led sector performance in July and was up +7.22%. Communication Services (-4.01%) and Information Technology (-2.09%) lagged for the month but still led the way over the previous year.

- The Russell 1000 Value rose +5.11% in July compared to -1.70% for the Russell 1000 Growth. The gap between Growth/Value performance narrowed but still favors Growth over recent years.

- The MSCI EAFE Index rose +2.93% for the month and is now up +8.43% for the year. Emerging Markets lagged a bit after a strong run but were slightly positive with the MSCI EM Index rising +0.30% in July.

- The 10-year Treasury yield continued to decline during the month, going from 4.37% to 4.06% as inflation cooled further and the Fed signaled a willingness to begin cutting rates later this year. The Bloomberg US Aggregate Index rose +2.34% for the month.

Download the full report HERE to see index returns and more.

Sources