ACG’S April 2024 Capital Markets Review

(Download the full report HERE)

Market Highlights

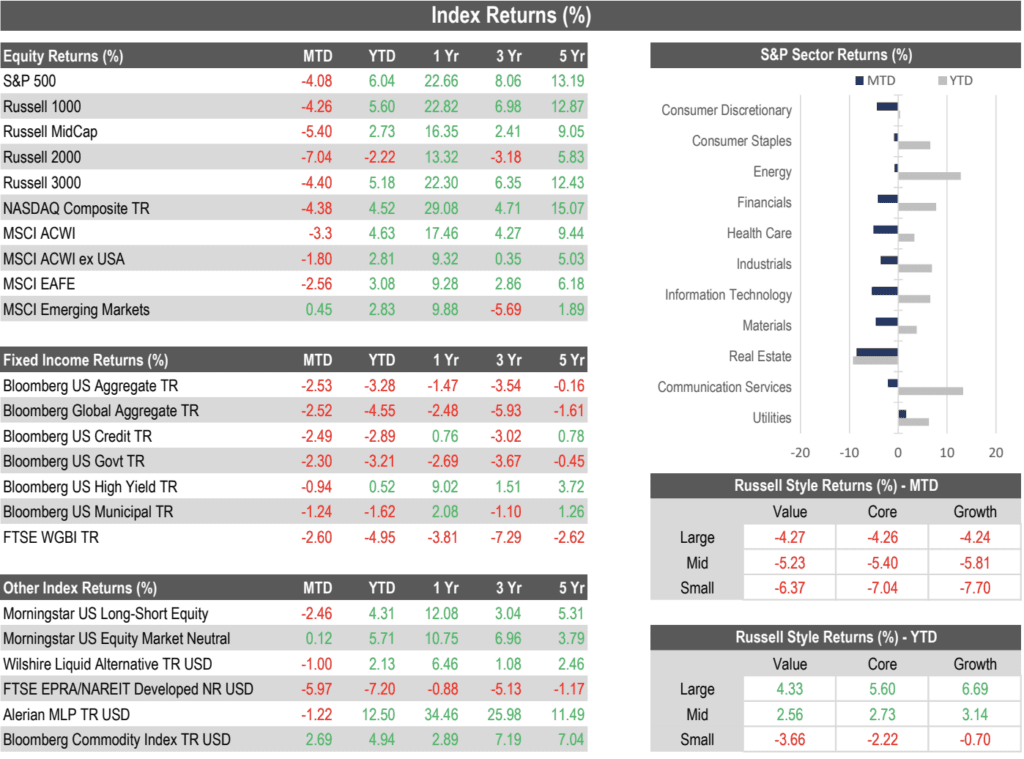

- April saw a meaningful pullback for markets after a strong first quarter as investors digested lower than expected growth and persistence with inflation data.

- The S&P 500 fell -4.08% for the month but is still up +6.04% year-to-date.

- Small Cap stocks led markets lower with the Russell 2000 falling -7.04% in April.

- The only positive S&P 500 sector for the month was Utilities while Real Estate, Information Technology, and Health Care all fell more than -5.0%..

- Growth and Value stocks were similar in April with both styles declining in-line with the broader market.

- Developed International and Emerging Markets enjoyed strong relative months compared to the U.S. with the MSCI EAFE Index only falling -2.56% and theMSCI EM increasing +0.45%.

- The 10-year Treasury yield shot from 4.21% to 4.69% in April amongst predictions that rates would stay elevated for the foreseeable future. The Bloomberg US Aggregate Index was down -2.53% for the month as a result and is now down -3.28% this year.

Download the full report HERE to see index returns and more.

Sources