ACG Market Review – Second Quarter 2025

Fill out the form below to receive full access to our Second Quarter Market Review and Video Commentary

- Economy – Fiscal policy ambiguity weighs on growth outlook and puts Fed in difficult position

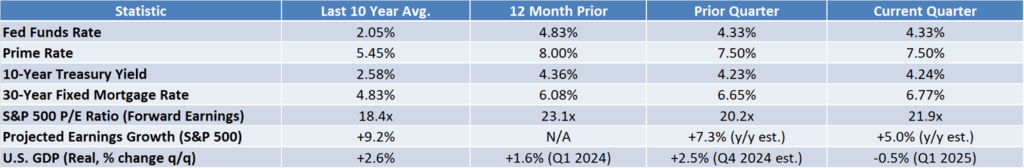

- The final estimate of Q1 2025 GDP showed the economy contracting -0.5% from the previous quarter, largely due to a sharp increase in net imports as companies attempted to front run tariffs.

- Trade policy announcements jolted market participants in early April with high tariff rates on a slew of countries before the administration paused or walked-back reciprocal tariffs. Another tariff “deadline” approaches early in Q3 with little further clarity.

- The U.S. Federal Reserve has held rates steady at higher levels than many developed countries as they await possible upward pressure on inflation from tariffs.

- Equity – Stocks shook off multiple headwinds and a volatile April to post a strong quarter

- After a quick correction in early April, the S&P 500 finished Q2 up +10.94% and is now up +6.20% for the year. Earnings estimates for the rest of the year have fallen but still show expectations for single-digit growth.

- U.S. Small and Mid Cap stocks have lagged so far this year but also enjoyed strong quarters overall. The Russell 2000 and Russell 2500 indexes rose +8.50% and +8.59%, respectively, in Q2.

- International and Emerging Market stocks continued a run of outperformance relative to the U.S. The MSCI ACWI ex USA index, which includes Emerging Markets, was up +12.03% for the quarter and is now up +17.90% year-to-date through June.

- Fixed Income – Bond markets wrestled with federal debt/deficit projections and tariff impacts

- The 10-year Treasury yield took a ride from approximately 4.0% to 4.6% before settling back near 4.2%, where it began the quarter.

- The Bloomberg U.S. Agg Bond Index ground out a +1.21% gain in Q2 as corporate bond spreads remained tight.

- Risks/Other Considerations

- Recession risk is back on the market’s radar as the impact of tariffs, immigration policy, and relatively restrictive monetary policy begin to trickle into hard economic data.

- Geopolitical events have historically not had major long-term impact on markets but could be a catalyst for disruption in specific cases if, say, energy markets are meaningfully impacted.

- Market Index Review

- Q2 2025: Tariffs and Geopolitics Dominate the Headlines

- Tariff Talk Receding, But Uncertainty Lingers

- After a Volatile April, Equity Markets Regained Footing

- One Big (Not So?) Beautiful Bill Act

- Deficits and Debt: How Much is Too Much?

- Economic Growth Projections Mixed

- Earnings Growth Still Solid Despite Lowered Estimates

- U.S. Equity Valuations: A Tale of Two Capitalizations

- Valuations Across Geographies

- Geopolitical Events and Their Affect on the Markets

- Energy Markets Update

- “The Only Thing We Have to Fear is Fear Itself”

- Fed Funds Expectations and Yields

- U.S. Becoming an Outlier When it Comes to Interest Rates

- Appendix: Private Equity Distributions Still Slow

Sources:

- Morningstar

- ACG

- Federal Reserve

- Factset

- Hedgeye

- Apollo

- Bank of America

- Bloomberg

- Standard & Poor’s

- Morgan Stanley Capital International

- CBO

- Joint Committee on Taxation

- Committee For a Responsible Budget

- Deutsche Bank

- Congressional Budget Office

- Atlanta Federal Reserve

- Charles Schwab

- LSEG Datastream

- Ed Yardeni

- Capital Group

- FTSE

- InterContinental Exchange

- U.S. Energy Information Administration

- Department of Energy

- Piper Sandler

- Bureau of Labor Statistics

- University of Michigan

- The Leuthold Group

- New York Federal Reserve

- FactSet

- Pitchbook

- Citigroup

Important Disclosures Language:

Important Disclosures

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by the Atlanta Consulting Group Advisors, LLC (“ACG”), including ACG’s Form ADV, Part 2A Brochure and all supplements thereto, before making an investment.

The information contained herein reflects the opinions and projections of the ACG as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. You should not treat these materials as advice in relation to legal, taxation, or investment matters.

Third-Party Websites

Third-party news, articles and links are being provided as a convenience and for informational purposes only. They do not constitute an endorsement or an approval by ACG of any of the products, services or opinions of the corporation or organization, or individual(s) involved. ACG bears no responsibility for the accuracy, legality, or content of the external site or for that of any subsequent links. Contact the external site owner for answers to questions regarding its content.

Connect With Us

Interested in learning more? The professional advisors at ACG are happy to answer any questions you

have. Contact us to discuss solutions and discover how our advisors bring value to your institution.