ACG Market Review – Q4 2023

(Download the full report HERE)

- Economy – An economic soft-landing in the U.S. moves from a low probability event to the consensus view

-

-

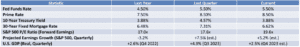

- Softer inflation data led to increased market expectations for Federal Reserve rate cuts in 2024 and into 2025

- The positive feedback loop for risk assets from the easing of finance conditions and Fed pivot was reinforced by a few other factors:

- The broader soft-landing narrative

- Consumer resilience

- Strong Q3 2023 corporate earnings and stable 2024 consensus earnings expectations

-

- Equity – Narrative around peak fed rates sparks widespread rally across equities

-

-

- U.S. equity markets saw a broadening of leadership following recent dominance of the Magnificent Seven

- Despite the broadening of the rally, most of the Magnificent Seven names all still outperformed in Q4 with AMZN +19.5%, MSFT +19.1%, META +17.9%, NVDA +13.9% and AAPL +12.5% all beating the market

- Small caps and other formerly out-of-favor areas showed strength during the quarter

- U.S. equity markets saw a broadening of leadership following recent dominance of the Magnificent Seven

-

- Fixed Income – Fed comments and economic data led to projections for a Fed pivot to cutting rates

-

-

- Treasury yields were volatile with a 2- and 10-year notes down 75 and 70 basis points respectively during Q4

- As a result of the above, most financial conditions indexes saw significant easing

- Fixed income investments saw some of the strongest quarterly returns on record

-

- Risks/Other Considerations

-

- Risk narratives centered around a potentially premature move to cut rates by the Fed, the lagged effects of the tightening cycle on corporate profits, overbought conditions following such a strong rally, and geopolitics focused on potential escalation in the Middle East and/or Ukraine

Download the full report HERE where we discuss:

- Market Index Review – December 2023

- Q4 2023: Is the Fed Really Done Raising Rates?

- Did We Just See that Much Anticipated “Fed Pivot?”

- An Economic Soft Landing Seems More Likely, But…

- …Recessions Always Start as Soft Landings

- Earnings Outlook Strong, But Not Without Risks

- The Effect of Rising Rates on Corporate Profits

- Bond Volatility: “November Was a Good Year”

- What Will 2024 Have in Store for Rates?

- Interest Rates to the Rescue!

- Despite Headline Returns, Not All Stocks Performed Well

- Europe Continue to Lag – Mostly Due to Fundamentals

- Where do Equities Go From Here?

- Risks: Higher Interest Rates Force Austerity

- Risks: Geopolitics

Sources:

- Morningstar

- Hedgeye

- Bloomberg

- Charles Schwab

- Federal Reserve

- Deutsche Bank

- Bureau of Economic Analysis

- NBER

- DataStream

- Standard & Poor’s

- Bank of America

- Strategas

- Bianco Research

- MSCI

- FTSE

- Topix

- Russell Investment Group

- Dow Jones

- FactSet

- Citigroup

- I/B/E/S

- Bureau of Labor Statistics

- MacroBond

- Haver Analytics

- Oxford Economics