ACG Market Review – Q1 2024

(Download the full report HERE)

- Economy – Recession forecasts have decreased meaningfully as the economy perseveres, despite some lingering inflation

-

-

- Year over year inflation readings continue to fall, but at a slower pace than the market has expected to remain above the Fed’s 2.0% target

- Service sector inflation has been elevated as food and energy prices have decreased within the overall CPI bucket

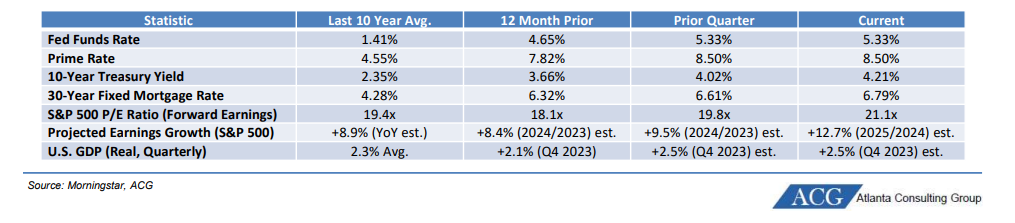

- The Fed has been reluctant to signal any imminent rate cuts, with market expectations showing fewer and fewer cuts this year, and some forecasters now calling for zero cuts in 2024

- Year over year inflation readings continue to fall, but at a slower pace than the market has expected to remain above the Fed’s 2.0% target

-

- Equity – Positive momentum for equities continued with the S&P 500 gaining +10.56% for the quarter

-

-

- Market leadership broadened from the Magnificent Seven, which could be a good sign for this bull market

- NVIDIA and Meta carried over strong performance from 2023 in Q1, while Amazon and Microsoft outperformed the broader market. Alphabet, Apple, and Tesla all underperformed the S&P 500 in Q1, with Apple and Tesla among the worst performers in the index for the quarter

- US Small Cap, International Developed, and Emerging Markets all had positive absolute quarters, but still trailed US Large Cap

- Japanese markets finally set new all-time highs for the first time since 1989

- Market leadership broadened from the Magnificent Seven, which could be a good sign for this bull market

-

- Fixed Income – Bonds are in a better place due to higher starting yields despite tepid performance during Q1

-

-

- Treasury yields rose slightly with the 10-year Treasury moving from just under 4.0% to around 4.2% during the quarter

- Yields across fixed income sectors are higher than two years ago, which should be beneficial for returns from both coupon payments and price appreciation as the Fed begins to cut rates

-

- Risks/Other Considerations

-

- Geopolitics continues to be a topic of conversation with conflicts ongoing in Ukraine, the Middle East, and renewed worries of a China/Taiwan engagement

- The recent performance of the US stock market has raised concerns about a potential bubble, but pockets of froth may not mean doom for the broader market

-

Download the full report HERE where we discuss:

- Market Index Review – March 2024

- Q1 2024: The Equity Market Market Rally Broadens

- Magnificent Seven (or Four Update

- Earnings and Valuations Differ by Size and Geography

- The Dominance of the Technology Sector

- A Historical Look at Equity Market Concentration

- Active Management Backdrop Remains Mixed

- International Markets: Japan Finally Moves Past Prior Peak

- Inflation is Coming Down…But Slowly

- Federal Open Market Committee Rate Decision Gets Tougher

- What Does The Latest Dot Plot Tell Us?

- On the Bright Side, Bonds Provide More Yield Today

- When it Comes to Rate Cuts, Speed Matters

- The Likelihood of a Recessions Depends on Who You Ask

- Risks: Geopolitical

- Risk: Artificial Intelligence

Sources:

- Morningstar

- ACG

- Hedgeye

- Russell Investment Group

- Charles Schwab

- Factset

- AllianceBernstein

- DataStream

- ASR Ltd.

- Dimson, Marsh, and Staunton

- Goldman Sachs

- Standard & Poor’s

- Bank of America

- Bloomberg

- Nikkei

- Bureau of Labor Statistics

- Ned Davis Research

- Conference Board

- Ray Dalio