ACG Insights: Thinking About Fossil Fuel Divestment

(Download the full report HERE)

Executive Summary

- It is widely accepted that transitioning away from fossil fuel dependence is crucial in the fight against climate change

- Institutional investors are increasingly implementing plans to divest from fossil fuel companies

- There is plenty of gray area as to how to define and implement a divestment strategy for investors looking to pull money from fossil fuel businesses

- Shareholder engagement can be an alternative or a complement to full divestment strategies by helping to enact climate-friendly changes within fossil fuel companies

- Investors should weigh some legitimate arguments against blanket divestment such as loss of shareholder influence or ceding economic influence to state-owned oil giants

Background

Setting the stage for the investment implications of divesting from fossil fuel companies is difficult without a quick aside into some science and history. As with many modern problems, there is much more nuance surrounding climate change and fossil fuels than the rhetoric shows. It is not necessarily contradictory to say that fossil fuel use has been a net positive for society while also endangering the planet via man-made warming and climate change. Back to some light science and history: pre-industrial societies primarily relied on muscle power or burning wood to provide energy for work and transportation. These methods were adequate for widely dispersed populations with relatively small-scale output needs. The world population began to increase exponentially during the 18th and 19th centuries as, or partially because of, a transition to coal and oil as a cheap energy source. Fossil fuels tend to be more energy dense than other energy supplies which made them an effective catalyst to power industry, transportation, and electricity generation. Somewhere around 60%1 of global electricity is still generated from fossil fuels, and most modern luxuries related to items like transportation infrastructure and cheap electricity are a direct result of extracting and burning fossil fuels. Despite the societal benefits to this point, agreement is widespread that the world needs to wean itself from fossil fuels to combat the effects of climate change. The nuance mentioned earlier that many institutional investors will have to grapple with is what, specifically, they are looking to accomplish, and how to invest to accomplish both environmental goals and fiduciary objectives.

The Case for Divestment

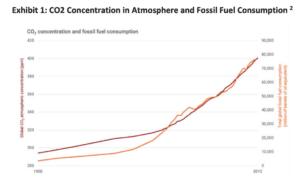

The rationale behind quitting fossil fuels for investors is black and white compared to the nuance of methodology. It has been widely agreed amongst the scientific and political communities that an increase in greenhouse gas emissions from burning fossil fuels is contributing to climate change. Exhibit 1 below shows the direct relation between consumption of fossil fuels and the concentration of carbon dioxide in the atmosphere. Rising global temperatures due to the greenhouse gas effect have been shown to impact weather, sea levels, ecosystems, and agriculture among other areas.

Naturally, economies and markets will feel the effects of climate change if it worsens over time. Investors have increasingly opted to fight climate change by pulling capital from coal, oil, and gas companies. Divestment strategies, in broad terms, aim to starve fossil fuel companies from funding or force change by raising their cost of capital to the point that the business of fossil fuels is no longer economically viable…

Download the full report HERE where we discuss

- Institutional Adoption

- Types of Institutions with Divestment Mandates

- Setting a Divestment Strategy

- Sample of Considerations for a Divestment Strategy

- Divestment vs. Engagement

- Climate-Related Shareholder Proposals and % Votes in Favor

- Arguments Against Divestment

- Top Carbon Emitters are Largely State-Owned

- % of S&P 500 with Emissions Reduction Targets

Sources:

- Source: Brookings Institute, https://www.brookings.edu/essay/why-are-fossil-fuels-so-hard-to-quit/

- Source: Global Fossil Fuel Divestment Commitments Database, https://divestmentdatabase.org/

- Source: MSCI ESG Research

- Source: Goldman Sachs Global Investment Research

- Source: Yale, “Report of the Committee of Fossil Fuel Investment Principles”

- Source: https://www.theguardian.com/environment/2019/oct/09/revealed-20-firms-third-carbon-emissions

- Source: https://theconversation.com/fossil-fuel-divestment-will-increase-carbon-emissions-not-lower-them-heres-why-126392

- Source: Bank of America Global Research