ACG Insights: Think Global Not Local

(Download the full report HERE)

Executive Summary

- Global growth is expected to come from outside the United States as global middle-class consumption ascends from nations like China and India

- Since the early 1990s, the globally diversified portfolio and the traditional 60% stock and 40% bond portfolio have traded market leadership, sometimes for lengthy periods.

- The recent strong historical performance of U.S. stocks and bonds have lowered expected returns for these asset classes over the next 10 years, making a globally diversified portfolio more attractive than the Traditional 60% stock and 40% bond portfolio

- No one knows which asset classes will outperform in the 2020s, making a globally diversified portfolio the best choice for long-term investors

Background

The 2010s was the decade of U.S. stocks and bonds as the Traditional 60-40 portfolio (60% U.S. stocks and 40% U.S. bonds) outperformed a globally diversified portfolio. U.S stocks benefited from the rise of Tech giants like Google, Facebook, Apple, and Amazon as they solidified their global dominance as well as Tech unicorns that transformed the U.S. economy and society. In the fixed income markets, low rates and quantitative easing were a boon to investors who held bonds as monetary policy pushed prices to all-time highs. Investors who held the traditional 60-40 portfolio saw handsome returns of almost 10% per annum throughout the decade, while putting money in a diversified basket saw less impressive annual returns of around 6.5%. Investors who stuck with similar positioning into the 2020s were rewarded, as U.S. stocks continued to outperform thanks to monetary and fiscal stimulus, and the rise of remote work due to COVID-19. U.S. stocks and bonds are currently at historically high valuations with U.S. stocks approaching valuations last seen since the dotcom boom. This is not to say that a crash is around the corner, but it acknowledges that asset returns going forward are most likely to be lower due to mean reversion, or the tendency for asset returns to revert to their historical mean over time. While low forward returns are likely the fate of U.S stocks and bonds, their international counterparts are trading at more attractive valuations. Investors could be rewarded by considering investments outside of the traditional U.S. stocks and bonds paradigm.

Expanding Opportunity Set

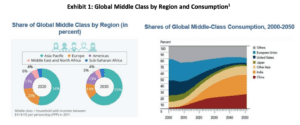

The global financial markets have seen rapid growth over the last decades as economies continue to develop and engage in global trade. Globalization has created prosperity for many as standards of living in developing nations converge towards advanced nations. In future decades, global growth will likely come from nations that are developing rather than developed ones like the U.S. In fact, global middle-class consumption has expanded and diversified to nations that are not located in North America or Europe. The below exhibits show the share of global middle class by region and the shares of global middle-class consumption.

In 2020, nearly 40% of the global middle class came from Europe and North America but by 2030 their share is expected to decline to under 30%. Global middle-class consumption will not come from these same developed nations as developing nations like China and India increase their share.

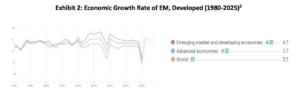

As more and more global growth comes from outside of the United States via an ascendant global middle class, investors are missing out on new opportunities by not allocating capital towards them. Nations outside the United States have demographic advantages such as younger populations, which act as a powerful tailwind for economic growth. According to the IMF, by 2025 Advanced Economies like the United States are expected to grow at less than a 2% rate. In contrast, the Emerging and Developing economies are expected to grow by nearly 5%. More companies coming from these developing nations are competing on the global stage. The rise of companies like Alibaba, Tencent and other Chinese tech companies are prime examples. A domestic only bias may have worked in the past, but in the future it could hurt…

Download the full report HERE where we discuss

- Markets Move in Cycles

- Global Diversified Portfolio vs. Traditional 60-40

- What’s on the Horizon?

- ACG Forecasted Returns Over Time

Sources:

- Brookings Institution

- OECD

- IMF

- Morningstar

- ACG Research

- Global Portfolio: (30%) Russell 3000; (15%) MSCI ACWI ex USA; (20%) Bloomberg Barclays U.S. Aggregate Bond; (30%) Bloomberg Barclays Global Aggregate ex USA; (5%) Bloomberg Barclays U.S. High Yield 1-5 Yr. – 10-Year Expected Return = 4.76% & Expected Risk = 7.53%

- Traditional 60-40 Portfolio: (60%) Russell 3000; (40%) Bloomberg Barclays U.S. Aggregate Bond – 10-Year Expected Return = 4.31% & Expected Risk = 9.70%