ACG Insights: Housing Crash Redux?

(Download the full report HERE)

Executive Summary

- Americans with excellent credit have decided to take advantage of the historically low-interest rate environment and buy homes further away from America’s largest metropolitan areas.

- Institutions, like pension funds, have seen residential real estate as an attractive place to invest thanks to the low return environment.

- Builders have struggled to keep with this new demand after underbuilding in the prior decade as COVID-19 supply shortages have caused prices of labor and building materials to increase.

- Supply and demand fundamentals are likely to remain in place for the near-term supporting housing prices.

Background

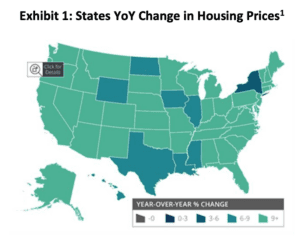

For decades, buying a home has been a part of the American Dream. It has been a reliable way to build wealth for many average Americans, and in turn, has become a key pillar of support for the U.S. economy. Up until the 2008 financial crisis, there were few recorded instances of housing prices falling nationally. In the run up to the 2008 financial crisis, Americans demanded houses at a rapid pace fueling a surge in prices. It was not until borrowers with the lowest credit profile, sub-prime, began defaulting on their mortgages that the music stopped for housing, and ultimately the global economy. Fast forward to 2021, and many are experiencing Deja-vu. In most states, housing prices rose more than 9% year-over-year in 20211 , with the national average posting double-digit returns. The strong price action has made people anxious to know if we are headed for another 2008 style meltdown. Although we do not like this phrase, it accurately describes our view. “This time may be different”.

Americans Scramble for Housing

When the United States entered lockdown in March 2020, millions of Americans found themselves confined to small living spaces in COVID hotspot cities. With many Americans working from home, the need for more space became imminent as people were “trapped” at home with children or significant others. Coupled with interest rates dropping, and projected to remain historically low for some time, Americans, took advantage and bought homes with more space in the lower cost cities near America’s largest and priciest metropolitan areas. A study conducted by the Cleveland Federal Reserve titled Migrants from High-Cost, Large Metro Areas during the COVID-19 Pandemic, Their Destinations and How Many Could Follow explainsthis point. In the study, the authors examined migration patterns pre-pandemic and during the pandemic. What they found was that the “bigger ‘winners’ from the changes in net migration during the pandemic are smaller metro areas near high-cost large metro areas”.

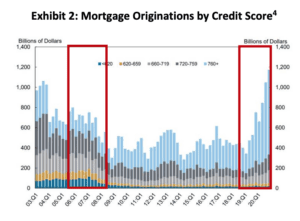

Today’s buyers, however, are different from that of 2008. In Exhibit 2, we see how the quality of borrowers has changed over time. In 2008, sub-prime borrowers, people with credit scores less than 620, were a noticeable share of new mortgages. These borrowers typically had low assets to put down on a home, and higher debt to income. When the housing market collapsed these borrowers were among the first to default on their mortgage loans. By 2020, sub-prime borrowers were almost non-existent with the bulk of home borrowers having excellent credit, credit scores north of 760. These high-quality borrowers tended to have COVID resilient jobs, ability to work from home, and higher levels of assets to afford home purchases.

Another key pillar of support of housing demand today has been the rise of institutional funds. In today’s lowinterest rate environment there are few places to put capital to work. Institutions, like pension funds, need to generate consistent returns to meet future benefit payments. This has forced some institutions to become more creative by including single-family homes as a part of their portfolio. The pandemic only accelerated this demand as residential housing was seen as one of the few initial bright spots of the U.S. economy at that time. Now institutions are competing against average Americans for homes, which is driving prices higher. In fact, a recent Wall Street Journal article titled If You Sell a House These Days the Buyer Might be a Pension Fund, a real estate consulting firm noted “’ You now have permanent capital competing with a young couple trying to buy a house. That is going to make U.S. housing permanently more expensive’”3 . As the competition among institutional investors and average Americans heats up, this only increases housing prices.

Download the full report HERE where we discuss

- Supply in Short Order

- Monthly Supply of Houses in the United States

Sources:

- Source: CoreLogic

- Source: Cleveland Federal Reserve Migrants from High-Cost, Large Metro Areas during the COVID-19 Pandemic, Their Destinations and How Many Could Follow

- Source: Wall Street Journal If You Sell a House these Days the Buyer Might be a Pension Fund

- Sources: Bureau of Economic Analysis; Barron’s calculations. As of 9.30.20

- Source: New York Times Where Have All the Houses Gone?

- Source: St. Louis Federal Reserve

- Source: Wall Street Journal U.S. Housing Market is Nearly 4 Million Homes Short of Buyer Demand