ACG Insights: Has the Game Changed?

(Download the full report HERE)

Executive Summary

- A spike in popularity of “meme” stocks has highlighted a recent trend of outperformance for beleaguered companies with poor financials

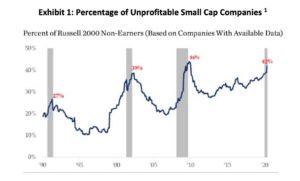

- Small Cap U.S. Equities have been a focal point of the trend, where the percentage of unprofitable companies in the Russell 2000 index has risen near peaks (Exhibit 1)

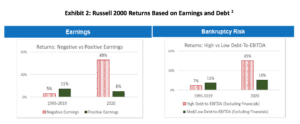

- The relative outperformance of lower quality compared to higher quality stocks in 2020 was substantial, but also a divergence from history (Exhibit 2)

- There have been cyclical swings favoring non-earners that have generally been short-lived and concentrated around recessions (Exhibit 3)

- Portfolio exposure to quality stocks in the small cap space can depend both on the active/passive decision and which index is followed by a passive manager (Exhibit 4)

Background

The year or so since COVID-19 burst into the collective world consciousness has seen an increasing number of rare eventsin markets. Some have been directly related to the pandemic, and some have been only tangentially connected. In the first category, there were examples such as the sharp decline and equally sharp recovery of market indices last spring, and unprecedented support from both monetary and government policymakers. Examples more indirectly related to the pandemic might be oil briefly trading for less than $0, or the renewed interest in all kinds of cryptocurrencies from Bitcoin to Dogecoin. Most recently, struggling companies like GameStop (GME) and AMC Entertainment (AMC) have seen their stock prices soar hundreds or thousands of percent in a few days led by an army of social media-connected retail traders. It has been well-documented how the pandemic and apps like Robinhood led to a flood of small traders in 2020. Smaller players fearful of missing out on quick gains will likely continue to ebb and flow with market cycles. The question here, with GME and AMC being prime examples, is whether the market’s recent infatuation with lower quality or unprofitable companies is a paradigm shift or a short-lived phenomenon.

The Rise of Non-Earners

It feels like a successful investment philosophy lately would be to disregard the actual business prospects of a company. A common theme that ACG has been hearing in recent meetings with fund management teams is that strategies based on fundamental research and focused on quality, profitable companies have struggled relative to their benchmarks. This premise has been especially pronounced with small capitalization equities, where businesses may not have the capital buffer relative to larger companies to weather a poor economy. The number of unprofitable companies naturally tends to peak during times of economic stress. Exhibit 1 below (gray bars represent recessions) shows that during 2020 the Russell 2000 approached a peak number of stocks not earning a profit last seen after the Great Financial Crisis.

The sheer number of non-earners in a low-growth, low-rate environment is likely one of many reasons for the recent rally in lower quality shares. Money has to flow somewhere, and investors have been willing to pay a premium for the possibility of earnings growth years in the future. It is almost certain that many of these nonearners will turn profitable as the economy bounces back from the pandemic. Will a reversal like this change much about the current environment for low quality stocks?

Quality vs. “Junk” Stocks

There is no established set of parameters for what constitutes a quality company. Most value-oriented asset managers have a proprietary list of data points they compile based on company financial statements to determine the health of a business. Alternatively, there are a couple common ways to screen for low-quality or “junk” stocks. Most filters will examine earnings and debt-levels. Companies with negative net income (usually measured over the previous 12 months), and/or elevated debt would be classified as “junk”. Fuller & Thaler Asset Management, who run a successful small cap fund based on behavioral finance, have some interesting data in their 2020 commentary. Exhibit 2 below, again using the Russell 2000, shows the extraordinary dispersion in stock returns last year compared to recent history when controlling for earnings and debt.

Companies with negative earnings and high levels of debt relative to earnings drastically outperformed in 2020. This difference in returns is a contrast to the prior two-and-a-half decades where quality produced better annual performance on average. Looking back even further, AQR Capital Management conducted a well-regarded study with data spanning 1957-2012 and found significant outperformance amongst small caps when controlling for quality. After establishing the history that quality small cap companies outperform given time, the original question of whether 2020 marked a shift in this rule becomes clearer…

Download the full report HERE where we discuss

- Was 2020 an Inflection Point?

- Relative Performance of Earners vs. Non-Earners

- Solutions for Thinking About Quality in Small Cap Funds

- Annualized Small Cap Index Performance Comparison

Sources:

- Source: Driehaus Capital Management

- Source: Fuller & Thaler Asset Management, Inc.

- Source: Glenmede Investment Management LP

- 4 Source: Morningstar Direct