ACG Insights: Equity Index Concentration

(Download the Full Report HERE)

Executive Summary

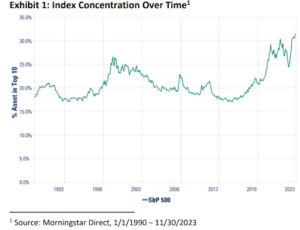

- S&P 500 index concentration has reached a new all‐time high (Exhibit 1). This has led investors, especially those who use passive vehicles, to evaluate the potential implications

- There are approaches to alter exposure, but they may be costly, challenging, or not make sense from a long‐term perspective

- Investors need to understand the concentrated exposures they are assuming when allocating to broad market indices

Background

Don’t put all your eggs in one basket. Easy enough. But what happens if one of your “core” baskets gets more concentrated due to the invisible hand of the market?

This is in reference to U.S. Large Cap Equity indices, where currently, a small number of securities are having an outsized influence on overall index performance relative to history. A heavily concentrated index reduces the benefits of diversification and can overexpose a portfolio to company or sector specific risk, which could lead to higher volatility. Currently, the top 10 holdings of the S&P 500 make up 32% of the index relative to the long‐term average of 20%. The Russell 1000 growth index is even more concentrated, with the top 10 stocks accounting for 52% of its weight!

How did we get here, what are the implications, and what should investors do?

Index Construction and the Magnificent 7

The S&P 500 and Russell 1000 are examples of market‐cap weighted indices that mirror the structure of the market by giving larger companies greater weights in the index. Sizing holdings in this manner is efficient due to its ability to reflect the market’s collective assessment of the relative value of each stock. Growing stocks take up more of the portfolio, while underperforming oneslose ground and become less significant. Absent an active view, investing in a passive index fund is an excellent approach to get exposure to the equity risk premium.

Download the full report HERE where we discuss:

- Magnificent 7 Weights, Returns, and Valuations2

- Passive Approach

- Possible Modifications

Sources

- Morningstar Direct, 1/1/1990 – 11/30/2023

- Morningstar Direct and Yardeni Research as of 12/20/2023

- Morningstar Direct

- FactSet, BofA Global Research as of 9/30/2023