ACG Insights: Debt Ceiling Drama

(Download the full report HERE)

Executive Summary

- Despite dozens of negotiated increases or suspensions of the U.S. debt limit over the past several decades, concern about the current debt ceiling is increasing

- Cash available for the Treasury to pay obligations is falling which makes a technical default on some payments feel possible, although still low probability, in the absence of a deal

- Historically, markets have shrugged off debt limit fears as short-term noise

Background

The government of the United States authorizes spending (government salaries, social programs, military spending, interest payments, etc.) and revenue (taxes) policies every year as part of the budgeting process. Regardless of the political party in power, spending generally outweighs revenue and the budget runs at a deficit. Fortunately, the U.S. government is also the strongest borrower in the world, prints its own currency, and can issue debt denominated in its currency to cover spending gaps. The market for U.S. Treasury securities has become one of the bedrocks of modern finance. Congress, well-known for perfect insight into future ramifications of decisions, acted during World War I to provide flexibility to the Treasury to raise cash to cover spending while also placing limits on specific types of debt1 . The aggregate debt limit of today was enacted during World War II to provide additional flexibility to the Treasury. It is important to note that prior to WWI, Congress had to approve each new debt issuance down to maturity and interest. As we approach another round of political posturing and market turmoil surrounding the debt ceiling in 2023, remember that progress is possible.

What’s Happening Now, and is it Different?

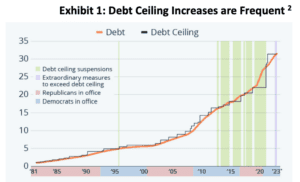

Since moving to an aggregate debt ceiling, Congress has simply raised or suspended the debt limit to allow the Treasury to finance existing spending commitments. The exercise has become routine on essentially an annual cadence, 78 times since 1960, and happens regardless of political party in power (49 times under Republican presidents and 29 times under Democrats). Exhibit 1 shows the pattern of debt and ceiling increases. The ceiling was last raised in December 2021 to $31.4 trillion and was breached in early 2023. The Treasury has measures to keep paying bills temporarily but will need to raise or suspend the ceiling by this summer to avoid defaulting on some of its obligations.

Raising or suspending the debt ceiling must pass through Congress and historically has been a routine exercise with a few exceptions. So, what feels different this time? Maybe nothing. A deal could be reached anytime to push the debate another few months or years. There is always the argument that media scrutiny has increased to a degree that everything feels more dire than even a decade ago. Political divisions and brinksmanship for show also feel worse but could just be more visible and publicly-watched. Most pundits agree that there is a high probability of an agreement before any kind of default and that the political consequences for both sides of failing to pay government debts, even temporarily, would be enough to warrant a deal.

What happens next?

Download the full report HERE where we discuss

- Available Treasury Cash is Dwindling

- Market Implications

- Stock Market Reactions Around Debt Crises

Sources:

- Bipartisan Policy Center: https://bipartisanpolicy.org/debt-limit-through-the-years/

- Statista: https://www.statista.com/chart/1505/americas-debt-ceiling-dilemma/

- U.S. Department of the Treasury: https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscalservice/debt-limit

- Bloomberg

- Allspring, “The Debt Ceiling: Frequently Asked Questions”

- Fidelity: https://www.fidelity.com/learningcenter/trading-investing/debt-ceiling

- CME Group: https://www.cmegroup.com/insights/economic-research/2023/debt-ceiling-lessons-from-the-2011-budgetdebate.html

- Committee for a Responsible Federal Budget, “Q&A: Everything You Should Know About the Debt Ceiling”