ACG Insights: Capitalizing on Opportunities in Global Equities

(Download the Full Report HERE)

Executive Summary

- Despite recent underperformance, investing in international equities can help minimize portfolio volatility, capitalize on market leadership changes, and expose investors to global industries that are less dominant in the U.S.

- For the most part, foreign stocks offer lower valuations currently, currency diversification, and have historically performed similarly to U.S. equities in higher interest rate environments

- A strategic allocation to international stocks and regular rebalancing can help promote portfolio resilience and benefits from global economic and market developments

Introduction

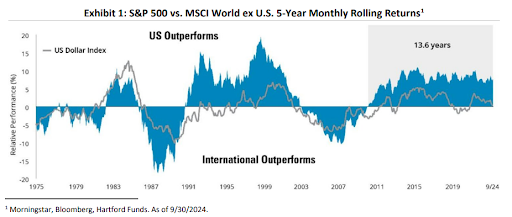

The past decade has showcased impressive U.S. stock market performance. Understandably, investors have grown frustrated with their international equity allocations that have not kept up with the steady and elevated returns of the U.S. Forget about diversification! Why not go all-in on U.S. equities? This natural tendency for U.S. investors to overweight assets within their own borders, known as home country bias, has been exacerbated by recent stellar performance from U.S. stocks.

Our latest ACG Insights explores the importance of global diversification, highlights the potential opportunities in foreign markets, and offers practical guidance for constructing a geographically balanced investment portfolio. Adopting a global perspective can assist investors in strengthening portfolio resilience, identifying undervalued assets, and improving positioning for future market cycles.

Risk Reduction Through Geographic Exposure

One of the primary advantages of international diversification lies in its potential to reduce portfolio volatility (Exhibit 2). Because geopolitical, economic, and market-specific risks differ from region to region, declines in one market might be offset by gains or stability in other areas. For example, during the U.S. financial crisis of 2008, certain international markets, such as emerging Asia, experienced less severe economic contractions as they were largely insulated from the U.S. housing collapse. By investing across regions, investors often reduce localized downturns and obtain more steady returns.

Download the full report HERE where we discuss:

- Cyclicality of Market Leadership

- Exploring the Global Opportunity Set

- Cyclical Case – Valuation

- Cyclical Case – Higher for Longer

- Strategic Allocation and Monitoring

Sources:

- Morningstar

- Bloomberg

- Hartford Funds. As of 9/30/2024.

- Lazard. As of 8/31/2024. Since inception 12/31/1969.

- Global Financial Data, Inc.

- World Bank Group

- World Federation of Exchanges Database. As of 12/31/2022.

- Brandes

- MSCI via FactSet. As of 9/30/2024.

- JPMorgan as of 11/30/2024