ACG Insights: August 2024 Market Volatility

(Download the full report HERE)

Executive Summary

- Multiple factors coalesced during the first few days of the month to send markets across the globe into turmoil.

- The Fed signaled a willingness to begin cutting rates in September, but market participants are beginning to wonder if they are behind the curve.

- Markets in Japan sold off significantly as their central bank decided to raise rates and the “carry trade” of borrowing Yen to buy higher-yielding currencies began to unwind.

- Geopolitical instability has spooked the markets with uncertainty around the timing and scale of Iran’s likely response to Israeli actions against Hamas and Iran’s proxies.

- Despite volatility, the U.S. economy and corporate earnings remain on solid footing.

Equity Volatility

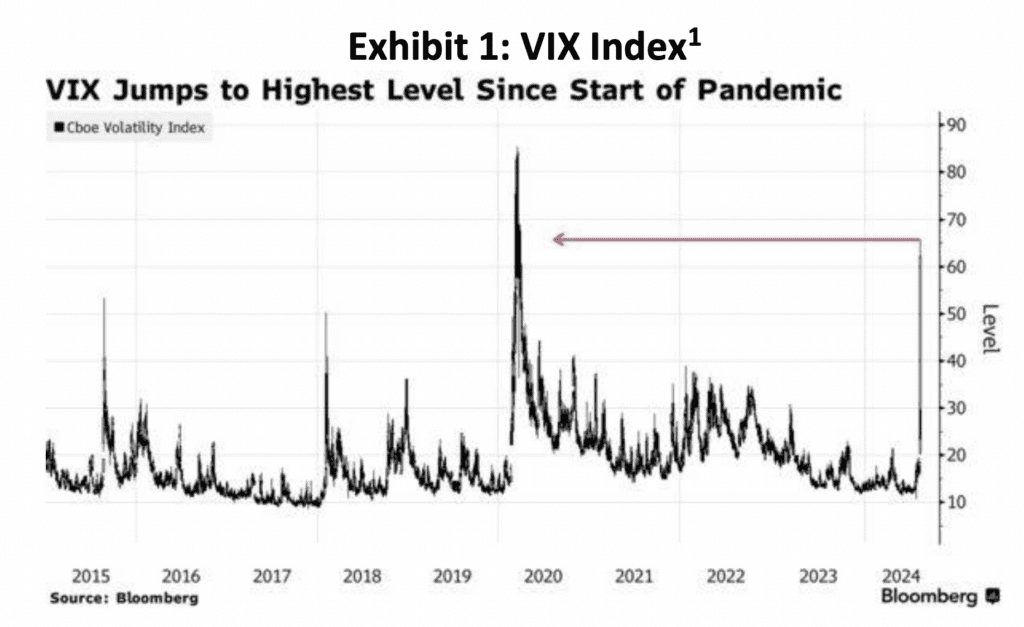

After a red hot first half of 2024 and a positive month of July, equity markets quickly became volatile in the first few days of August. A confluence of events all seemed to capture investor attention in the span of a few days, as the VIX index rose to the highest level since the pandemic in 2020 (Exhibit 1).

Download the full report HERE where we discuss:

- The Fed and the Economy

- Japanese Yen and The Carry Trade

- Geopolitics

- Corporate Earnings

Sources: