ACG Insights: 2023 Capital Market Assumptions

(Download the full report HERE)

Executive Summary

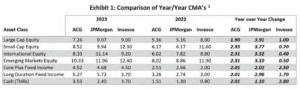

- The market reset from peak levels in early 2022 has meaningfully increased forward return assumptions as firms publish 2023 Capital Market Assumptions (Exhibit 1)

- One of the most important inputs when projecting forward returns is an assumption of the current risk-free rate of return (Exhibit 2)

- Much of the increase in 10-year return expectations can be attributed to a higher risk-free rate as fixed income yields have increased significantly from last year (Exhibits 3 & 4)

Background:

Many investment firms go through an annual exercise of forecasting long-term returns for various asset classes. These assumptions, often 10-year forward looking, serve the dual purpose of helping investors set strategic asset allocations and think about the interplay between risk and return on a long-term horizon. Capital Market Assumptions (CMA’s) tend to be a routine exercise in many cases in that not much will meaningfully change from year to year. 2022 provided an exception to the routine. As ACG and other research groups publish 2023 assumptions, there have been significant upward revisions to return expectations across asset classes due primarily to substantial resets in valuations and interest rates in 2022.

Market Reset Lifts Forward Return Expectations

Exhibit 1 below illustrates the magnitude of the shift from last year using ACG’s CMA’s alongside two prominent Wall Street firms (JPMorgan and Invesco). All major asset classes have been revised higher, some by 2-3% or more annualized, which can potentially mean elevated returns when extrapolated over 10 years. There is a considerable degree of uncertainty inherent to long-term forecasts that is visible in the wide range of numbers in Exhibit 1. Different models will yield different results year-to-year, but a consensus of results over long periods tend to converge toward similar predictions.

Download the full report HERE where we discuss

- What Explains the Upward Revisions?

- Illustrative Example of the Importance of Risk-Free Rate

- Silver Lining of Higher Yields

- Yield on a 10-year Zero Coupon Bond

- Correlation Between Current Yield and Bond Returns