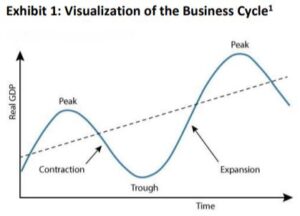

(Download the full report HERE) One headline in the financial news cycle that is almost guaranteed to get clicks looks something like: “Prominent Economist sees Recession Coming Based on These Three Signals.” Given the diversity and size of the U.S. economy, there is always data available that can be used to argue either side of the economic health debate. There is a widely cited rule of thumb that two consecutive quarters of declining real GDP constitutes a recession. This can be a useful definition in the same way that a sore throat indicates an illness, but there is a range of outcomes from a mild cold to something more serious. Negative GDP growth readings can be a telling symptom of wider issues in the economy. The full picture requires data points beyond just GDP and some knowledge of more acronyms like NBER (National Bureau of Economic Research) and BCDC (Business Cycle Dating Committee). We will attempt to lay out some of the processes and metrics used to determine recessions to save the reader from some research, although like most areas of finance and economics there is a level of subjectivity to officially calling a recession. There are also any number of “alternative” recession indicators covering trends in pizza purchases to men’s underwear sales that range from amusing to slightly informative about the current state of the economy. Most everyone has had some exposure to the business cycle, represented visually by a wave pattern (Exhibit 1) where the economy expands to a peak and contracts to a trough over time. The time from peak to trough is considered a recession. But who determines a peak and a trough? What metrics determine the direction and magnitude of economy-wide cycles? The National Bureau of Economic Research (NBER) is a nonprofit founded in 1920 by, somewhat shockingly, a communications executive and a pro-labor socialist who predictably disagreed on policy but identified a need for reliable data and information to discuss economic issues. It’s important to note that NBER has remained steadfast in their mission to present research and data without making policy recommendations. NBER is funded through grants and charitable contributions and is led by an impressive list of academics and business professionals. The Business Cycle Dating Committee (BCDC) consists of macroeconomic and business cycle experts appointed by the president of NBER, whose basic purpose is to monitor, identify, and maintain a chronology of economic cycles. The BCDC identifies recessions as a part of this process by documenting the month of each peak and trough throughout the business cycle. In an economy as large and diverse as the United States, the tricky part is measuring and determining turning points accurately and as objectively as possible. Download the full report HERE where we discuss: Interested in learning more? The professional advisors at ACG are happy to answer any questions youACG Insights: Diagnosing a Recession

Executive Summary

Introduction

NBER and the BCDC

Sources

Connect With Us

have. Contact us to discuss solutions and discover how our advisors bring value to your institution.

Important Disclosures

Investing is subject to a high degree of investment risk, including the possible loss of the entire amount of an investment. You should carefully read and review all information provided by the Atlanta Consulting Group Advisors, LLC (“ACG”), including ACG’s Form ADV, Part 2A Brochure and all supplements thereto, before making an investment.

The information contained herein reflects the opinions and projections of the ACG as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. You should not treat these materials as advice in relation to legal, taxation, or investment matters.

Third-Party Websites

Third-party news, articles and links are being provided as a convenience and for informational purposes only. They do not constitute an endorsement or an approval by ACG of any of the products, services or opinions of the corporation or organization, or individual(s) involved. ACG bears no responsibility for the accuracy, legality, or content of the external site or for that of any subsequent links. Contact the external site owner for answers to questions regarding its content.